Currently Empty: Rp0

Blogs

This point is going to be particularly useful for individuals who’lso are saving to own specific needs or looking for a method to help you speed up the offers. You can allocate as often or as low as your’d such for the certain membership, otherwise have the full amount transferred under one roof. Perhaps one of the most common types of redemption is an announcement credit, and that reduces your an excellent harmony. Including https://happy-gambler.com/stack99-casino/ , for those who get $fifty inside the dollars-straight back, it’s applied straight to their bank card expenses, decreasing your balance. For those who come in part to open up that it membership, it’s along with value inquiring when you yourself have people pre-recognized mastercard also provides, since these by the admission the fresh Chase 5/twenty-four laws (more about these types of also provides here). Pursue Business Done Checking doesn’t have fee every month when you care for an everyday lowest equilibrium away from $dos,one hundred thousand or even more.

Checking

- As you may well not have the unique perks from superior profile, you could make the most of overdraft security in the event you occur to overdraw and Chase’s greater system from payment-totally free ATMs.

- “Pursue Individual Buyer” ‘s the brand to possess a financial and you can investment tool and you will services offering, requiring a great Chase Private Consumer Checking℠ account.

- CIT Bank features a different extra on their Precious metal Family savings, awake to help you $3 hundred after you deposit at the least $25,000 within the earliest thirty days.

- We’re going to include so it to our list of the best bank membership incentives.

We understood I got and make a big pick so i utilized that it on my advantage plus the extra try one of the largest incentives I obtained out of a lender. I was able to utilize they on the my personal report and other anything expected. Once more, this criteria of having such on the financial otherwise transported can be unpleasant. The method alone to open the fresh membership has also been a bit a lot more since the I sent all necessary documents, however, for some reason it got destroyed.

Could you Avoid the Month-to-month Fix Fee When you get a Pursue Bank Extra?

The bonus give consists of specific conditions and terms from a number of exclusions that could disqualify you from acquiring the new $one hundred extra also. You’re a single-owner along with your company label will be your actual label used because of the DBA (doing business while the). Excite see the hook a lot more than where you are able to rating a coupon from the typing their email address. From time to time, Pursue could have targeted also offers which aren’t in public areas readily available and can vary regarding the info the thing is that here. You will find very Pursue coupons in this article or by the clicking here showing latest Pursue offers.

With regards to bank account bonuses, Pursue is among the most our bestest buddies as much as, running repeated incentives on the the private and you may company top. Being qualified purchases were debit cards sales, Chase QuickDeposit℠, ACH (Credits), wires (credit and you will debits), Pursue Online℠ Bill Spend and you may Chase QuickAccept®. QuickAccept card money is actually shared to your you to every day being qualified transaction. Constantly nice to see a bonus with no direct deposit expected, simultaneously no monthly costs to worry about. You have got 90 days to meet the fresh head deposit requirements.

The advantage isn’t available for those who’ve had a great TD bank account open before 12 months otherwise received an excellent TD Offers extra in past times. When you over your requirements, the added bonus was deposited within 180 weeks. Once you’ve accomplished these criteria, your $200 extra will be paid inside 60 days. And signing up for a different checking account, you’ll must also register for an update credit. The two preferred is the Lifetime Perks Cards and also the Cash Rewards Cards.

When you are somebody who choose to visit an actual financial branch at least the main time, Pursue may be ideal for your, based on in your geographical area. If or not you are living near a Chase branch or otherwise not, you will possibly not have enough time to go to your financial as often since you’d such as. As well as, you could potentially log into the Pursue membership to see exactly how much you have got allocated to borrowing at any time. For many who’lso are trying to find a means to monitor your expenses on the internet, take a look at Pursue statement-pay. Our expert reviewers keep cutting-edge degree and you will qualifications and now have ages of experience having individual cash, later years considered and you may investments. You could unlock a good Pursue Prominent Along with Family savings myself by visiting your neighborhood department or on the internet, by using these types of steps.

Pursue Complete Examining® account extra: $three hundred

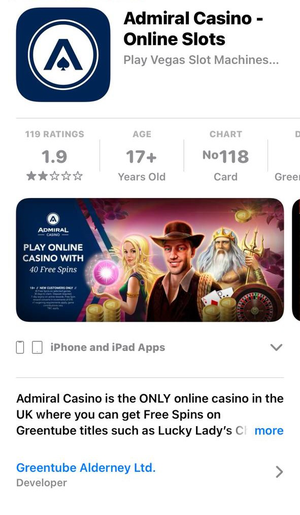

Those who have done a Chase incentive ahead of will do it once again once couple of years. Come across the opening time of when you opened the last checking/discounts account (perhaps not the bonus day), next wait two years just before beginning the newest account. Pursue seem to have attractive sign up incentives to attract new customers. And all sorts of you have to do is actually open a different Pursue bank account utilizing the promo password and complete the qualifying issues, which are different by membership. The brand new Pursue College Checking account is perfect for people 17 to help you twenty four years of age. It’s got zero opening put conditions, and you may conveniently access your money any kind of time Chase part or Atm.

Heartland Borrowing from the bank Relationship

He’s got got a $three hundred bonus in past times, but zero gaurantee offering tend to come back. Harder to keep percentage free compared to the current $3 hundred added bonus, but obviously an extra $one hundred. Addititionally there is a good $three hundred Computer game bonus you can do at the same time.

U.S. Lender provides as much as a good $step 1,2 hundred greeting bonus when you unlock and you can finance a new, qualified business family savings. The business account your open will establish simply how much bonus currency you can be eligible for. Perhaps you’re also anywhere between perform, try notice-working, or your boss will pay your because of the look at or even in dollars.

This really is a tiny incentive but worth performing if you’ve currently done big bonuses listed above. One ACH put is useful for that it, doesn’t need to be direct deposit/payroll. Usually KeyBank also provides a bonus of up to $300 but only in certain most particular parts, which appears to be for sale in a lot more section than simply typical. If you’re also provided that it render (and you’ll) this may be’s worth performing sooner rather than later because it tend to ends earlier’s indexed to help you expire. This calls for a month-to-month lead put from $dos,500 otherwise $5,one hundred thousand.